Sheet Cake Finance and Employee Owned Burgers in D.C.

Reporting out from this week's White House Convening on Worker Ownership

Top line: On Thursday, representatives from multiple federal agencies met with employee ownership advocates at the White House.1 This year marks fifty years since Congress wrote employee stock ownership plans into law, and this week’s conversation suggests next half-century is bright for employee owners.

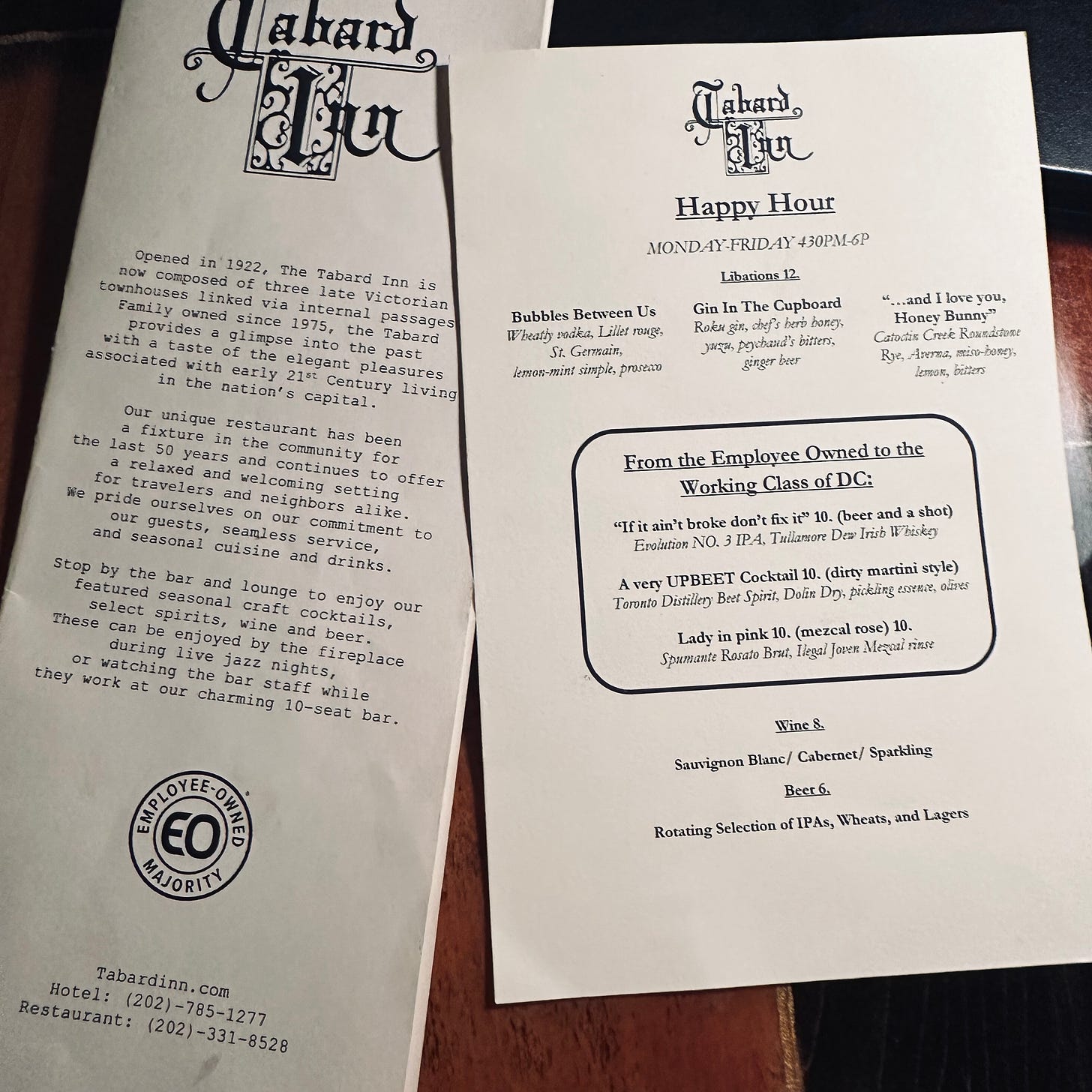

A fun aside before we get into it: The Tabard Inn, according to its menu (get the burger!) is the longest-running inn in Washington, D.C.:

It is also Certified Employee Owned, having had an employee ownership stock plan (ESOP) since 1993. It was just the right place to stay (Thx Ashlyn) for a one-night trip to DC for the first ever White House gathering on employee ownership.2

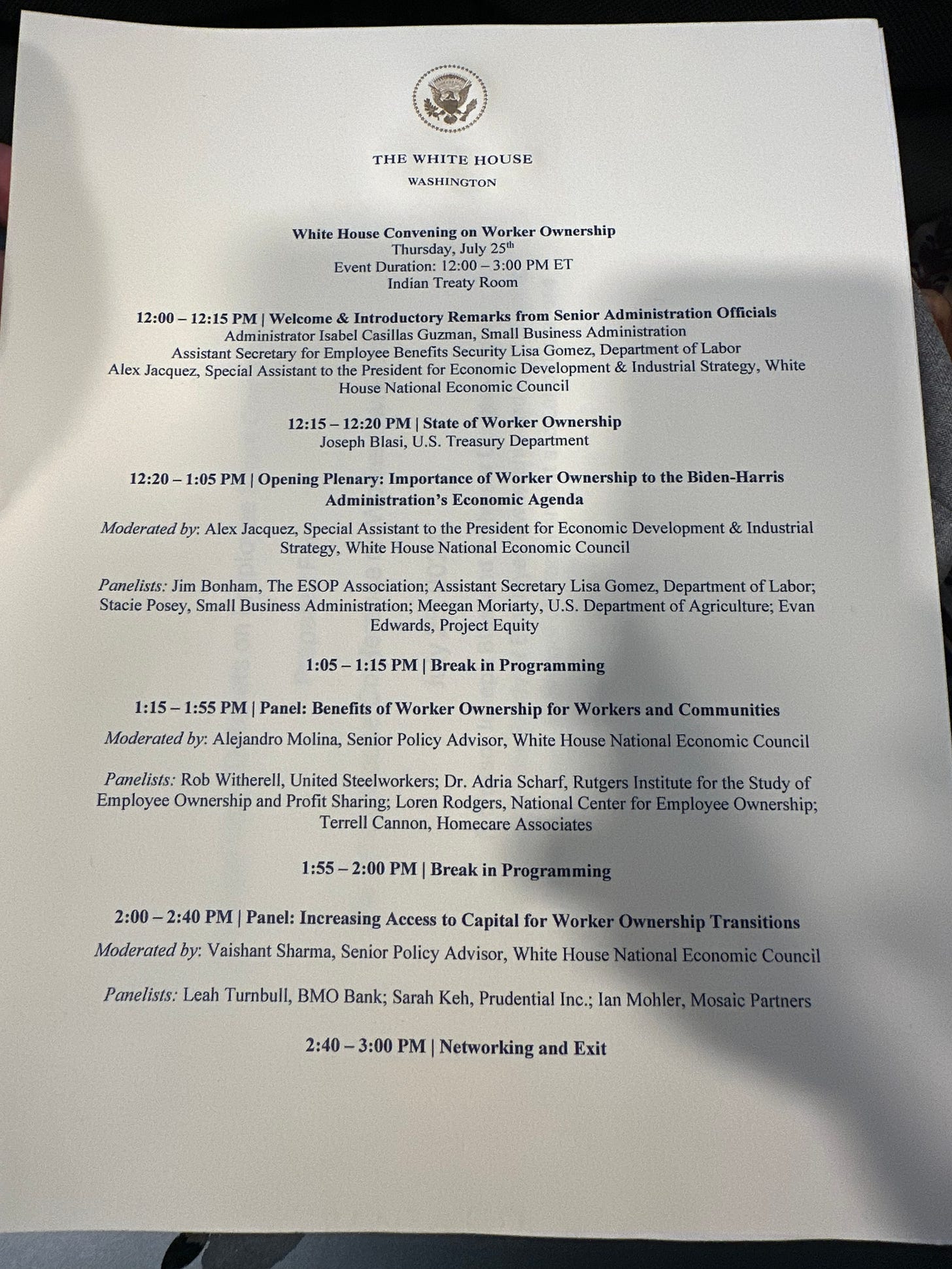

Who was there: The convening was organized by Vaishant Sharma and Alejandro Molina from the National Economic Council, held in the Indian Treaty Room, and included employee ownership advocates, investors, philanthropists, academics (🫡) and high level officials from the NEC, USDA, DOL, Treasury, and SBA:

What went down: Squint at the panel topics above if you like. Here are some takeaways, big and small and random:

These agencies really want to support employee ownership. USDA has a hundred-year history with cooperatives. SBA has updated a number of regulations to make it easier for its lenders to work with employee owned firms. DOL now has a Division of Employee Ownership, wants to be an advocate in addition to a regulator, and recently hired longtime employee ownership advocate Hilary Abell to help do it. Joseph Blasi recently worked inside the Treasury to expand its State Small Business Credit Initiative (SSBCI) to include employee owned firms.

Just about every form of employee ownership was represented in the room. The focus was (rightly) on ESOPs and worker cooperatives, which make up most of the broad-base employee ownership in the US. But equity compensation, direct ownership, private equity employee ownership, and employee ownership trusts were all represented in the content and on the invite list. Occasionally you’ll hear these groups don’t play well with one another. I haven’t seen that, and they were certainly all playing ball this week. Maybe there used to be more beef and division in this space. In my short two years writing about this stuff, I’ve found a healthy level of tension among employee ownership advocates, sure, but mostly there are good vibes—or at least the industry equivalent of people agreeing not to talk about politics over Thanksgiving dinner.

Scale is clearly the shared goal here, especially in the face of the coming tsunami of small business owner retirements. The finance-oriented folks, of course, think access to capital is the primary obstacle; the policy-oriented folks believe policy is the lever for scale. The nonprofit advocacy folks tended to argue for awareness-raising. No one made the argument that we really desperately need are more peer-reviewed academic papers. Sorry, fellow nerds!

For the first time in a long time, I’m told, a union representative was at this employee ownership meeting. I think that a brilliant stroke by the organizers—there is so much potential there. One puzzle to solve is finding legal and cultural structures that align employee ownership advocates and labor activists, two branches of the same tree. One example: the employee ownership folks in the room used the word ownership to talk about financial asset-building, as in an ESOP, and voice in reference to worker participation in decision-making. But the union leader used the word ownership to mean worker participation in decision-making, and benefit plan to talk about financial asset-building. What might sound like splitting hairs about word choices, I would argue, reflects deeper philosophical positions about what is most important about worker ownership, that will need to get ironed out together. I wonder if there’s policy space for multiple kinds of worker ownership, incentivized in different ways. There’s no reason, in theory at least, why the US couldn’t have one program that rewards companies for building employee wealth (like ESOPs do) and another program that rewards companies for structurally incorporating owners into decision-making (called codetermination).

One of the repeated messages was the resilience of employee owned companies are—something reflected, perhaps, in the longevity of the Tabard Inn. NCEO is going to put resources to some studies on that here, but employee owned firms last longer in the Department of Defense’s procurement program, survived the pandemic better, and in the US agriculture sector have been around for decades, some for over 100 years, according to Megan Moriarty.

It was hard not to imagine what might be possible, given this broad and now consolidating support for worker ownership across the federal government. Two things jumped out at me. First, some of the agency folks talked about wanting to “hit the road” to make sure the people they worked with understand employee ownership as an option for transitioning businesses. One way to do that would be to use the White House’s convening power to pull together different groups of service providers that they interact with—lenders, lawyers, accountants—to educate them specifically on employee ownership. A second path would be to go local. I’d love to recreate this week’s national gathering in Texas, with each agency’s local representatives championing employee ownership at the state level, in conjunction with state level agencies (here’s looking at you, TXCEO).

At EO+WD, we spend quite a bit of time focused on purpose trusts, including ownership trusts (see our recently released policy recommendations on those). I couldn’t help but hear the case for them in the room, especially for small businesses. ESOPs don’t work for businesses with <$2m in EBITDA, and really more like <$5 million.3 Worker cooperatives can work there, if owners are ready to make the jump on both financial ownership and worker control. EOTs are another tool that could fill this gap, if they’re not.

I have to say, though, my favorite moment of the day was when Terrell Cannon from Home Care Associates, a home health care cooperative in Philly, talked about how they help their worker-owners understand finance: sheet cakes! They use the cake to show where revenues go, what profit remains, and how it’s distributed. Maybe it’s just because I’m nostalgic for the white icing on cookie cakes, but I thought that pretty clever. Terrell shared with me, too, that one of the worker owners had suggested it as a way to help educate her colleagues. That—plus the actual sheet cake and Tabard Inn’s employee owned burgers—is the good stuff.

Ok, technically we were in the Eisenhower Executive Office Building. But it’s part of the White House complex, the invitation came from the NEC, which reports to the president, and the EEOB is where the Vice President offices. I’m counting it; change my mind.

The first time a president addressed the question of worker ownership was in 1792, before the White House was built. H/t Jospeh Blasi!

If you’re not into finance, this will sound made up. It is! EBITDA is finance jargon for profit, so this means “makes less than two million dollars a year in profit.” Finance folk use EBITDA because profit can actually mean a lot of things, whereas EBITDA is harder for wily business owners to manipulate.

Thank you for the detailed report, Mark! I'd been looking for this. Any chance that some of the presentations were recorded?