Ownership Culture, Citizen Mindset

How a Dallas private equity firm's view of ownership culture compares to others

TLDR: There’s no agreed-upon definition of ownership culture; investors and owners and employees are all working this out in real time. But common threads seem to include:

Sharing financial upside. Providing employees with a meaningful financial stake in the company, and aligning incentives through profit-sharing and/or bonuses tied to company performance

Sharing information. Sharing company performance data and financials with employees, and communicating the connection between the company’s core values and its work practices

Sharing decision-making and agenda-setting power. Empowering employee voice and participation in decision-making processes, with explicit channels and rhythms for upward communication

Sharing developmental opportunities. Supporting employee growth through personalized career paths and training opportunities, in particular on business/financial literacy

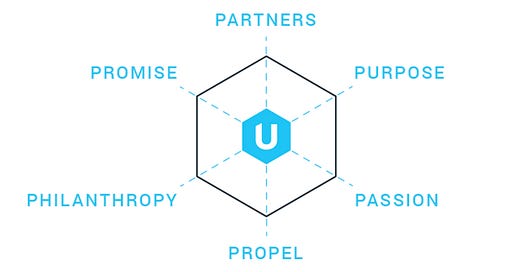

Background: I got to have lunch in May with John Block, co-founder of Unity Partners, a Dallas-based private equity fund that includes a form of employee equity in each deal they do (thanks for the connect, Jocelyn!).

The model is similar to that of Ownership Works, which we’ve written about before. Employees receive a pre-determined payout when the private equity firm that buys a company sells it on.

Co-founder Bryan Adams experienced the power of employee ownership when he sold his own company, Integrity Marketing Group.

Building an Ownership Culture

John and I spent a lot of time at lunch talking about Unity’s commitment to employee ownership,1 and I really appreciate how they lay out in plain language on their website:

We believe there is a multiplying effect when individuals unite.

We believe employee ownership aligns organization's on shared goals.

We believe an organization's values are its most scalable asset.

For Unity Partners, building an ownership culture is similarly straightforward: it revolves around communication, transparency, and accountability.

Other Approaches to Building and Ownership Culture

John and Bryan aren’t the first to think about these issues, of course, and it’s a topic I’ve been meaning to spend some time researching. Here are some of the things I found and found helpful:

The National Center for Employee Ownership runs a survey companies’ ownership culture (read more about it here), which includes six things.

Providing a financially meaningful ownership stake, enough to be an important part of employees’ financial security.

Providing ownership education that teaches people how the company makes money and their role in making that happen.

Sharing performance data about how the company is doing overall and how each work group contributes to that.

Training people in business literacy so they understand the numbers the company shares.

Sharing profits through incentive plans, profit sharing, or other tools.

Building employee involvement not just by allowing employees to contribute ideas and information but by making that part of their everyday work through teams, feedback opportunities, devolution of authority, and other structures.2

Project Equity boils it down to initiative, trust, clarity, and participation.

In an 2021 HBR article, Ethan Rouen and Certified EO co-founder Thomas Dudley say that ownership culture-building activities include “regular education on the rights and responsibilities of ownership, financial literacy training, recognizing individuals who act with an ownership mentality, and changing organizational processes to give employee-owners an increased role in day-to-day decision-making.”

KKR, the private equity firm that launched Ownership Works, has eight bits of guidance, with my apologies to the reader that they don’t rattle off very well as a list: it starts with the foundation of economic ownership; culture thrives and dies with senior leadership; make culture & engagement a strategic priority; consistent and transparent communication is key; give employees greater voice; provide training and upskilling; invest in financial literacy; reward and recognize.

The Great Game of Business is a method of open-book management, or sharing your financial statements with employees. Great Game / ESOP consultant John Williams compiles a similar list to NCEO’s, writing that ownership culture comes down to sharing information, teaching budgeting, widening participation in decision-making, and sharing risk.

Kerry Siggins, business owner and member of the Colorado Employee Ownership Commission, just published The Ownership Mindset. I haven’t read it yet, but I’m eager to—if any of you readers would like to write a review, let me know!

Ownership Culture, Citizen Mindset?

For a political scientist like yours truly, all this talk of ownership mindset echoes writing about political and civic participation, as well as workplace democracy.

But it’s Sunday, and gathering all the above took more time than I thought, so those comparisons will have to wait!

Some of our readers will take issue with the use of the word ownership here. That’s for another post!

I don’t know the backstory here, but it seems like this work builds on an out-of-print 2011 book by Corey Rosen and Loren Rodgers, Fundamentals of Ownership Culture. A 2013 article says the components of an ownership culture are: Level of ownership that is financially significant to employees; Understanding of the terms and conditions of the ownership plan; Skills training to increase effectiveness; Sharing financial and performance information with employees; Short-term financial incentives like prof-it-sharing and bonuses (in addition to the long-term benefits of stock ownership); and Employees have structured, regular opportunities to have meaningful input into decisions concerning the work they do.