Understanding Mixed Income Neighborhood Trusts

How MINTs Can Address Housing Shortages

The new East Colfax Mixed-Income Neighborhood Trust (MINT) in Denver, Colorado, seeks to build high quality housing with affordable rents, and build up the surrounding community. Intrigued, I decided to dive deeper into the concept of MINTs—check it out!

Why Does This Matter?

Many neighborhoods suffer from disinvestment, leading to a lack of resources and support to revitalize communities. This often affects single-family homes or smaller units, which already don’t receive assistance from state or national programs. When neighborhoods do get support, it often leads to marginalized communities getting disproportionately affected by gentrification. Additionally, housing prices hit record highs in 2024. Although some other programs and laws attempt to address these issues, such as the Biden administration’s combat against rent gouging, they fall short. This is where the Trust Neighborhoods solution—Mixed Income Neighborhood Trusts, or MINTs—come in.

How Does It Work?

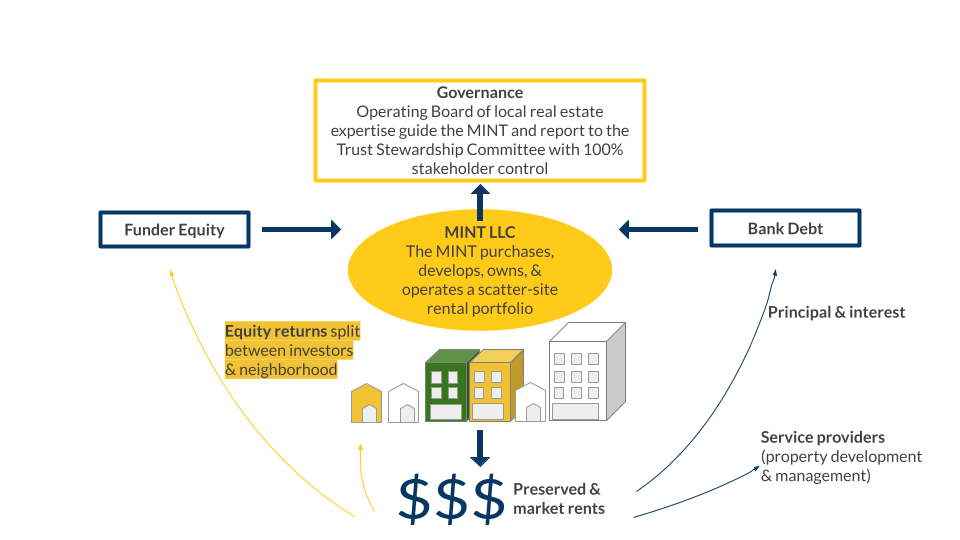

Mixed-Income Neighborhood Trusts partner with an existing community-based organization (CBO) in a targeted neighborhood. Trust Neighborhood assists with establishing a rental house portfolio for these communities and raising capital for the community-controlled MINT. That community then acquires, renovates, and builds the collection of properties. With the MINT, two thirds of those properties will be as affordable as possible, forever. As the community revitalizes, the last third of the properties, which are kept at market-rate rental prices, help keep the remaining two-thirds of units affordable.

Like worker cooperatives, neighborhood trusts work together to benefit the community as a whole. In turn, this allows stability, cooperation, relationship building, and a higher standard of living for mixed-income neighborhoods. Community members oversee all operations of the MINT, keeping the decision-making in the hands of residents.

Current MINTs and Looking Forward

There are currently five active MINTs. The first MINT was established in the Lykins Neighborhood Association in Kansas City in 2020. Neighborhoods in Fresno, Tulsa, Boston, and Denver have also established MINTs. The East Colfax MINT in Denver aims to expand to 100 units in the next year and 1000 in the next decade.

Some Questions

New to purpose trust ownership, I had a few questions as I was learning about MINTs for the first time.

What happens if property values in the area drop significantly—how would that impact the community’s ability to sustain the trust? Are there other revenue streams that could keep the trust sustainable?

Would trust ownership make disaster recovery easier or more complicated?

With only five MINTs in the country so far, it’s hard to imagine them scaling quickly enough to solve America’s housing crisis. But it seems like a great solution to revitalize communities and establish more equitable rental prices in individual neighborhoods. Thanks for reading!