The Great Wealth Transfer and the Case for Employee Ownership

Exploring Ownership Capital Lab's latest white paper

In March, Ownership Capital Lab released its white paper titled “The Silver Tsunami, the Great Wealth Transfer and the future of employee ownership in the United States.”

As an organization, Ownership Capital Lab focuses on “strategies for financing employee ownership at greater scale.” Their mission is to increase these investments in employee-owned businesses by $1 billion within the next five years. This paper explores the upcoming generation of retiring business owners (the “silver tsunami”) and the opportunity that employee ownership has in transitionary models to address economic inequality.

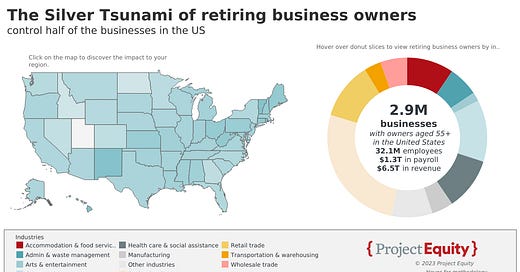

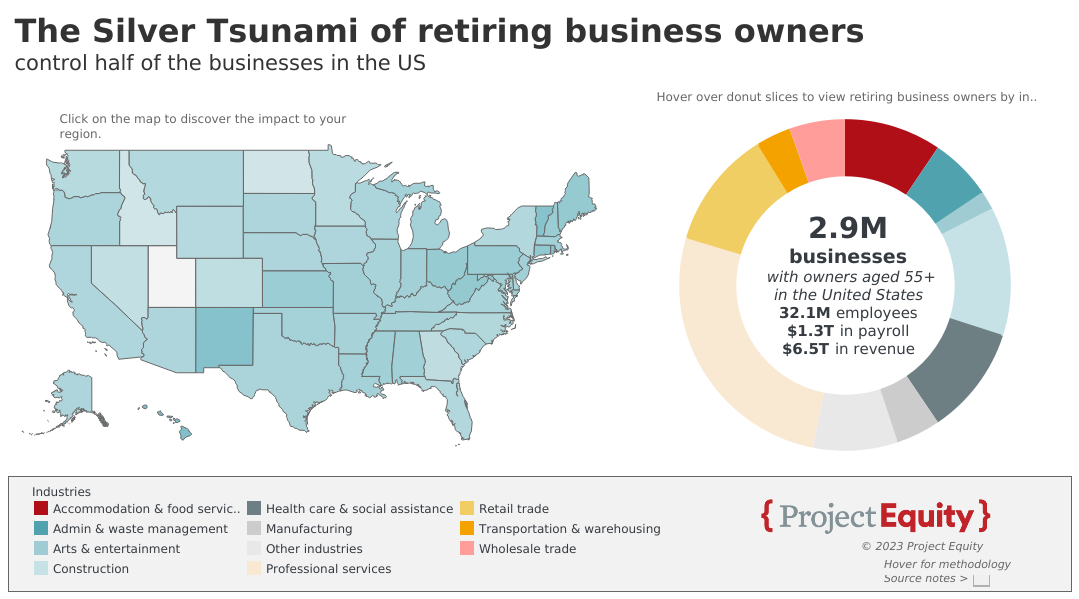

OCL’s new white paper builds on Project Equity’s statistics on the upcoming retirements of business owners. There are 2.9 million small businesses whose owners are near retirement age and that have a total of 32 million employees. This silver tsunami is accompanied by “The Great Wealth Exchange,” where $124 trillion of wealth will be transferred to younger generations. With this wealth transfer, Ownership Capital Lab estimates that donor-advised funds will increase rapidly to $4.5 trillion.

Employee ownership has garnered bipartisan support, with recent legislation and endorsements from public officials (including the newly appointed Secretary of Labor) highlighting its momentum.

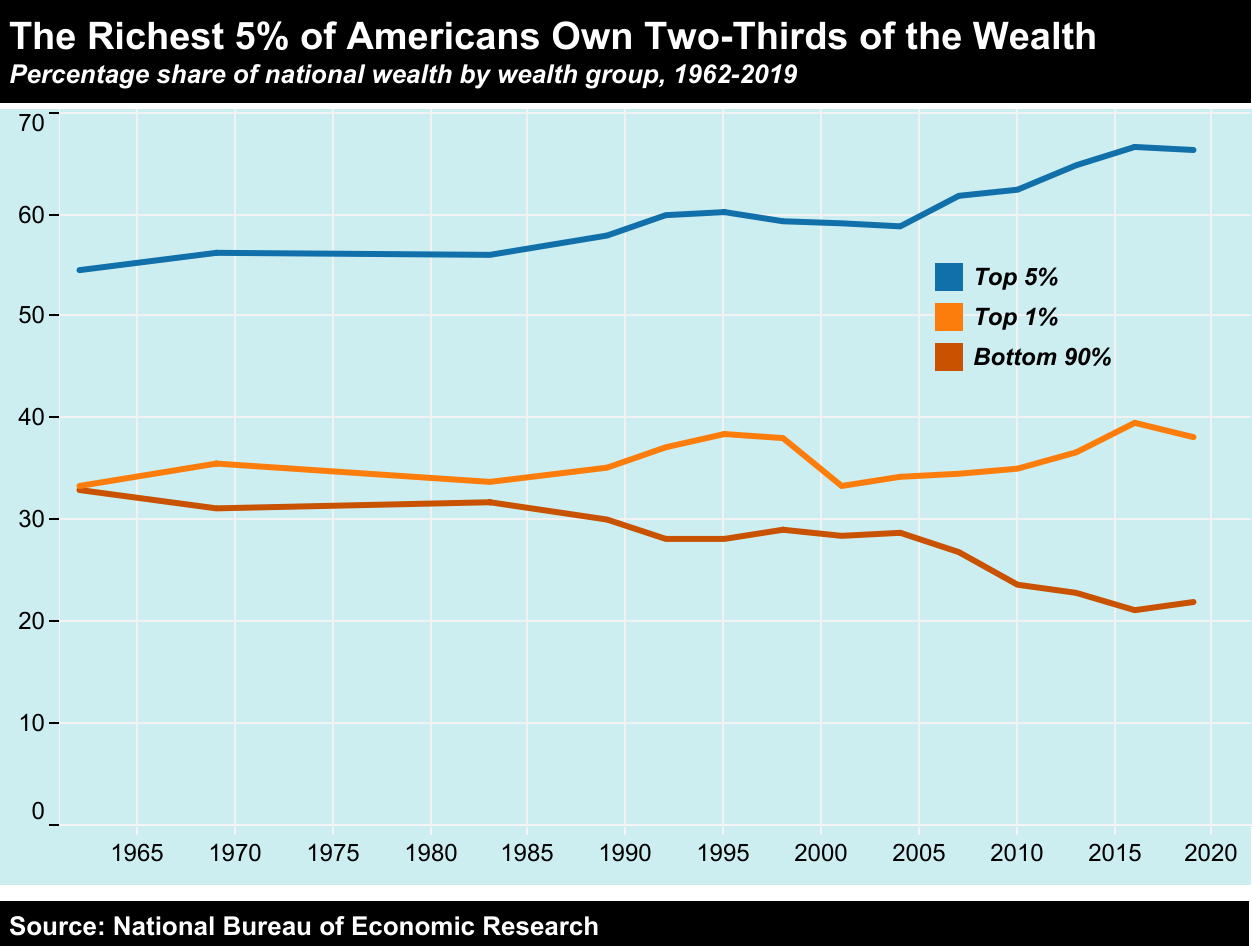

But why do this? One reason is to tackle wealth inequality. Wealth in the United States is highly concentrated, with the top 5% of households holding over 65% of wealth. Wages have stagnated, with marginalized communities getting hit disproportionately. Employee ownership helps shift wealth into the hands of workers. Amongst a retiring generation of owners, adopting employee ownership models—rather than selling or merging with another company—can redistribute wealth to the people who are producing it.

The paper outlines a few main points for employee ownership to take root among the silver tsunami:

The case for investing in employee ownership right now

Small businesses make up 99% of businesses and half of all private sector jobs in the US

Only one in five business owners finds a buyer, leaving room for employee ownership

Employee ownership can improve the quality of jobs through higher engagement, productivity, and growth, with lower layoffs

Over time, employee ownership can generate hundreds of thousands of dollars in employee-owner retirement accounts

Background on employee ownership in the US

18% of the US have some form of ownership, usually through stock options (though at the Aspen-Rutgers Employee Ownership Ideas Forum, Joseph Blasi said that 51!% of Americans own shares—we’ll get to the bottom of this)

Employee stock ownership plans (ESOPs), employee ownership trusts (EOTs), and worker cooperatives are all viable forms of employee ownership

OCL believes that there is “untapped demand” for employee ownership

Barriers include limited availability of capital, complex transitions, and a lack of awareness

Employee ownership funds

Employee ownership is underinvested. The $500M in assets under management by employee ownership funds represents 0.0139% of the $3.6 trillion (yes, trillion) of assets under management by private equity firms

Public investment like the SBIC program can help finance employee ownership transitions, which is how most employee ownership comes about

Read the full Ownership Capital Lab white paper here. Thanks for reading!